If you seek out any BFSI industry analysis and an update on the expected BFSI trends 2023, then chances are that you’ll find technology playing a predominant role in the scheme of things.

Most of the trends in the banking sector in 2023 are more geared towards swift technological adoption and harnessing its benefits for better outcomes in varied segments.

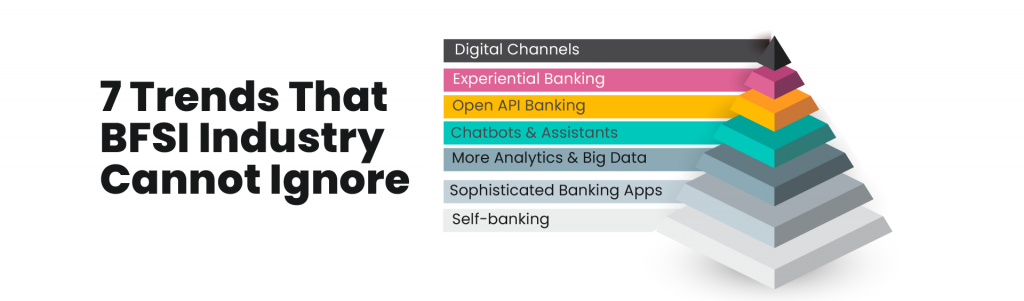

On that note, here’s taking a look at seven such trends that cannot be ignored by the BFSI sector anymore in 2023.

If recent trends in banking are an indicator, then more customers will focus on digital channels and platforms for banking solutions including mobile and online banking, as opposed to in-person, phone, or branch-based banking.

Many banks may switch to hybrid modes of operation while closing down chunks of their branch networks.

Another one of the current trends in the banking industry is greater emphasis on customer experiences. Many institutions are already looking at enhancing customer experiences, offering more convenience, engagement, and convenience, along with security.

Customers will increasingly expect this along with more personalized offers and service. More banking players will use analytics and other tools for reducing costs, enhancing outcomes, and anticipating customer needs.

Another one of the trends in banking sector in India and also worldwide, pertains to open API banking. It will ultimately enable banks to swiftly exchange data with outside players or fintech companies which enable quicker and secure digital transactions.

Many European and American banks have already taken this route with good results. This will eventually enable banks to build opportunities for cross-selling various products or other transactions.

Most banks will look to become technology-powered players in 2023 and will make increasing use of Chatbots and virtual assistants for smarter banking services.

NLP (natural language processing) will be a standard foundation for customer interactions this year. This will also free up personnel for more crucial activities.

Banking sector players will focus more on consumer behavior with the help of big data, while offering more personalization and boosting revenues thanks to predictive analytics. Analytics will help banks cross-sell, personalize, differentiate, and learn more from consumers, while gaining valuable insights.

Banking applications will evolve towards becoming preferred platforms for customer relationship management, while anticipating user requirements and offering personalized guidance and assistance.

Software tools will delve into the consumer’s financial behavior, history, and other factors towards becoming assistants for understanding requirements better. They will forecast demand for various aspects and notify users accordingly.

Customers will want to partake of banking experiences on their own in most cases. Self-service options will be commoner across branches or even ATMs, enabling quick account opening and other functions.

Retail banking will flow into digital realms, with better self-service abilities, faster and more secure transactions, and higher access for everyone. This will ultimately enhance customer experiences greatly.

Automated and convenient procedures will also boost the quality of banking services this year, while self-service functions will be more driven by more advanced analytics and virtual assistance too.

These are the seven trends that cannot be put aside by the BFSI industry any longer in 2023. They will eventually reshape and re-imagine the future of banking, especially in areas like personalization, forecasting, insights, consumer experiences, and accessibility.

These could well be the defining BFSI trends 2023 that are set to revolutionize the whole space considerably.